About richmond bankruptcy attorney

Assistance. Does the corporate give a qualified personal who will pay attention and understand your individual situations, and craft a prepare especially for you? Or Are you interested in a more generic, off-the shelf choice?

It should. Among the biggest black marks on your credit score score is possessing late or missed payments, and consolidating your entire credit card debt into a single regular monthly payment causes it to be additional possible you'll pay back punctually.

You'll should Are living in this funds for as much as five years. All through that time the court will constantly Check out your paying, and may penalize you severely for those who aren't subsequent the system. Seem like enjoyment? To major it off, it's going to stay on your own record for 7 yrs.

Declaring bankruptcy really should only be deemed A final resort. Depending upon the style of bankruptcy you file, you may be required to market your property, fulfill with (and respond to thoughts from) each of the folks that you choose to owe money, Reside beneath a courtroom-requested price range for approximately 5 several years, experience a giant strike on the credit history rating, and obtain it challenging to get a house, a car or truck, or a personal mortgage for around ten years.

Do you have got any choice with regards to the period of time you commit with an attorney? Far more time Using the attorney is much more individualized, but may be a increased Expense.

And - even when most of the personal debt is erased via a bankruptcy filing, you'll usually nevertheless owe 100% of one's scholar loan debt and taxes.

That differs. Some providers don't you can try this out charge anything at all for his or her solutions, supplying counseling together with other tools to teach you how to about your funds and how to spend down your debts.

For those who're thinking of submitting for bankruptcy, you're not by yourself. Annually, a my company huge selection of thousands of people file for bankruptcy on account of their mind-boggling debt.

On the other hand, some debts, like pupil find out here now loans and taxes, will keep on being. You can find demanding specifications for who qualifies for this type of bankruptcy. And it will keep in your file for 10 years, which could a fantastic read effects your capability to get a house, receive a automobile, or simply get a occupation.

Additionally you may very well be needed to satisfy While using the folks you owe revenue to, and Reside underneath a courtroom-ordered finances for as much as 5 yrs. And that's just To begin with.

Maybe you have heard about Chapter 7 and Chapter thirteen bankruptcy (All those are the two most popular bankruptcies for people), but Do you realize there are actually 6 kinds of bankruptcy available? Below's a short rundown of the different types of bankruptcy filings:

Arrive at Economic concentrates on financial loans for the goal of keeping away from bankruptcy. The company has an excellent popularity, equally Along with the BBB and its shoppers.

But that's not the only real rationale - reduced income, task loss, out of control paying out, and sudden charges see page are all significant contributors to fiscal challenges. Usually persons locate by themselves with a large credit card debt stress as a result of no fault of their own individual.

How can folks get in such money distress which they consider bankruptcy? Perhaps not surprisingly, A lot of people uncover on their own in a bad personal debt problem resulting from unexpected health care fees.

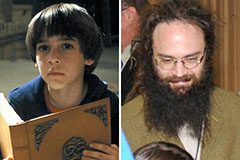

Barret Oliver Then & Now!

Barret Oliver Then & Now! Romeo Miller Then & Now!

Romeo Miller Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Nancy McKeon Then & Now!

Nancy McKeon Then & Now! Tyra Banks Then & Now!

Tyra Banks Then & Now!